What Are Derivatives in Stock Market2024

Contents

Demystifying Derivatives: The Stock Market’s Contracts for the Future

The stock market can be a complicated beast, and sometimes financial terms get thrown around that leave us scratching our heads. Today, we’re tackling one of those terms: derivatives. Don’t worry, though – this guide will break down derivatives in the stock market into easy-to-understand bites.

Imagine a Contract for the Future

Let’s say you love mangoes, and you know the price always skyrockets in the off-season. You could strike a deal with a friend today, agreeing to buy mangoes from them at a fixed price in, say, six months. That’s a simple derivative! The value of your contract depends on the future price of mangoes (the underlying asset).

The Stock Market’s Take on Derivatives

In the stock market, derivatives are contracts between two parties that derive their value from an underlying asset, like a stock, bond, commodity (like oil), or even an index (a basket of stocks). These contracts are agreements to buy or sell the asset at a predetermined price by a certain date.

Why Use Derivatives?

There are two main reasons people use derivatives

- Speculation: Imagine you think a stock price will go up. You can buy a derivative contract that lets you buy the stock at a certain price in the future. If the price goes up, you can exercise the contract (buy the stock) at the lower price and then sell it at the higher market price, making a profit. It’s like a bet on the future!

- Hedging: Let’s say you’re a farmer worried about falling corn prices. You can buy a derivative contract that guarantees you a certain price for your corn harvest later. This way, even if the market price crashes, you’re protected. It’s like an insurance policy for your investments!

Types of Derivatives: A Glimpse into the Toolbox

There are many types of derivatives, but here are three common ones

- Futures Contracts: These are agreements to buy or sell an asset at a specific price by a specific date.

- Options Contracts: These give you the right, but not the obligation, to buy or sell an asset at a certain price by a certain date.

- Swaps: These are essentially customized contracts where two parties exchange cash flows based on an underlying asset or index.

Important Note: Derivatives are Complex

While this article gives you a basic understanding, derivatives can be complex financial instruments. They can be risky, so it’s crucial to do your research and understand the risks involved before diving in. Consider talking to a financial advisor before making any decisions.

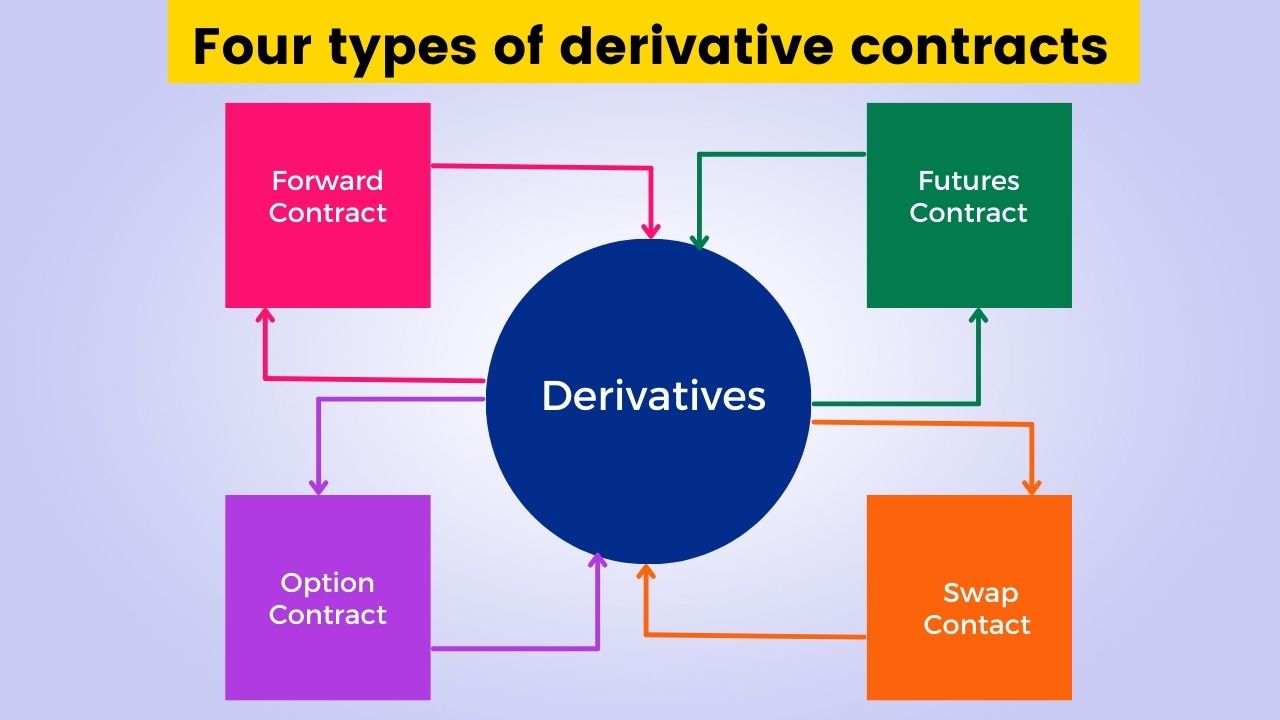

What are the 4 types of derivatives?

The world of derivatives has a few different players, but the four most common types of derivatives in the stock market are

- Futures Contracts: Imagine shaking hands on a deal today to buy or sell a specific amount of a stock (or other asset) at a predetermined price on a specific date in the future. That’s a futures contract! Both parties are legally obligated to follow through with the trade at that set price, no matter what the market price does in the meantime.

- Options Contracts: Think of options contracts as getting a “buy one, get one potential discount” coupon for a stock (or other asset). This contract gives you the right, but not the obligation, to buy or sell the asset at a certain price by a certain date. It’s like having the option to take advantage of a future price swing, but you’re not forced to if the market moves against you.

- Swaps: Swaps are essentially customized agreements between two parties. They agree to exchange cash flows based on an underlying asset or index. Imagine Company A has a fixed interest rate loan and Company B has a variable interest rate loan. They could do a swap where Company A takes on B’s variable rate and B takes on A’s fixed rate. It’s a way to manage risk and exposure to interest rate fluctuations.

- Forward Contracts: These are similar to futures contracts, but they are private agreements between two parties and not traded on an exchange. They’re less standardized than futures contracts and can be customized to fit the specific needs of the counterparties.

What is the difference between trading derivatives and stocks?

Here’s a breakdown of the key differences between trading derivatives and stocks

Ownership vs. Contracts

- Stocks: When you buy a stock, you become a partial owner of the company. You have rights like voting on company decisions and receiving dividends (a portion of the company’s profit).

- Derivatives: You don’t own the underlying asset (stock, commodity, etc.) with derivatives. Instead, you’re trading a contract that derives its value from that asset.

Focus and Risk

- Stocks: Typically used for long-term investment, aiming to benefit from company growth and potential dividend income. Risks include company performance and market fluctuations.

- Derivatives: Derivatives can be used for speculation on short-term price movements or hedging existing holdings. They are generally considered riskier due to leverage (potentially magnifying gains and losses) and complex contract terms.

Delivery vs. Speculation

- Stocks: When you buy a stock, you intend to hold or sell it at some point, but you take ownership with the purchase.

- Derivatives: Derivatives contracts often have expiry dates. You might fulfill the contract by buying/selling the underlying asset, but many options contracts expire without exercising (buying/selling) if not profitable. The focus is often on profiting from price movements before the expiry.

Examples

- Stocks: You believe a tech company has strong growth potential. You buy shares of the company’s stock, hoping they increase in value over time.

- Derivatives: You think the price of a stock will rise in the next month. You buy a call option contract, giving you the right (but not obligation) to buy the stock at a certain price by the expiry date. If the stock price goes up, you can exercise the option to buy low and sell high for a profit. If the price falls, the option loses value and may expire worthless.

SRM Contractors IPO Allotment Status Today

What is a derivative in NSE?

In the context of the National Stock Exchange of India (NSE), derivatives are financial contracts that derive their value from underlying assets like stocks, indices, commodities (like gold or oil), or even currencies. These contracts are essentially agreements between two parties to buy or sell the underlying asset at a predetermined price by a specific date.

Here’s a breakdown of how derivatives function on the NSE

- Types of derivative contracts: The NSE offers various derivative contracts, with the most common being

- Futures contracts: Agreements to buy or sell a specific quantity of an underlying asset at a set price on a future date.

- Options contracts: Grant the right, but not the obligation, to buy or sell an underlying asset at a certain price by a certain date.

- Trading Derivatives on NSE: The NSE provides a dedicated platform for trading derivatives. Investors can buy and sell these contracts just like regular stocks.

Why use Derivatives on NSE?

There are two main reasons investors use derivatives on the NSE

- Speculation: If you believe a stock’s price will go up, you can buy a call option contract. If your prediction is correct, you can potentially make a profit by exercising the option to buy the stock at a lower price and then selling it at the higher market price.

- Hedging: Let’s say you’re a company that relies heavily on oil. You can buy futures contracts on oil to lock in a fixed price for your future oil needs. This protects your business from sudden price fluctuations in the oil market.

Things to Remember

- Derivatives can be complex financial instruments and involve significant risks.

- It’s crucial to understand the risks involved before trading derivatives on the NSE.

- Consider consulting a financial advisor to ensure derivatives are suitable for your investment goals and risk tolerance.

Additional Resources

The NSE website offers a wealth of information on derivatives trading. Here are some helpful links

- About Equity Derivatives, Index Derivatives – NSE India: https://www.nseindia.com/market-data/equity-derivatives-watch

- Equity Derivatives Market Watch, Trading & Products – NSE India: https://www.nseindia.com/products-services/equity-derivatives-products

The Takeaway: Derivatives – A Tool, Not a Toy

Derivatives can be a valuable tool for experienced investors, but they’re not for everyone. If you’re a beginner, it’s wise to focus on understanding simpler investment options before considering derivatives. Remember, knowledge is power, so keep learning and happy investing!

Stocks are a more traditional investment approach focused on company ownership and potential long-term growth. Derivatives are complex financial instruments used for speculation or hedging, with higher risks and rewards compared to stocks. Before diving into derivatives, it’s crucial to understand the risks involved and potentially seek professional financial advice.